Online Trading Platforms:

Coinbase is the main platform we discuss on this site. While other platforms are out there, Coinbase is publicly traded and holds digital currency in custody – which is a big deal.

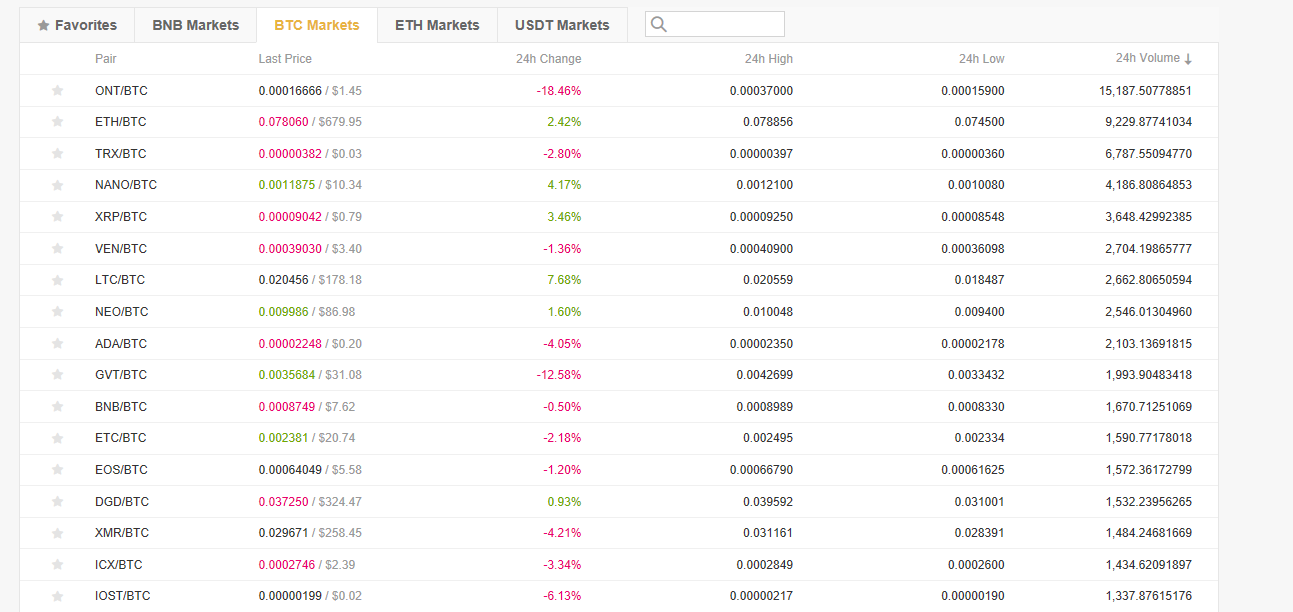

Coinbase is a trading platform for many different digital currencies. You can trade the larger ones, like Bitcoin and Ethereum as well as many others you may have heard of. You can also trade lesser known coins:

With digital currencies, the markets are open 24 hours a day, 7 days a week.